AlphaInterval is a cloud-based SaaS platform engineered for financial and economic professionals, offering powerful solutions for data processing, analysis, and visualization. With AlphaInterval, you can effortlessly manage time-series datasets while handling series-breaks—ensuring that your analysis remains accurate and reliable across reporting cycles.

Built to deliver deep insights, AlphaInterval helps you make critical financial decisions with precision and confidence, even in the face of complex regulatory shifts.

Ahead of the Curve: Leveraging Open Government Data for Financial Insights

AlphaInterval empowers financial institutions to fully harness the potential of Open Government Data (OGD), providing advanced tools to process, analyze, and visualize machine-readable datasets from the U.S. government. These datasets, while invaluable for financial and economic analysis, often suffer from regulatory changes that introduce series breaks, complicating consistent analysis. AlphaInterval's strength lies in its ability to handle these shifts seamlessly, preserving data integrity and adapting to evolving structures without sacrificing the granularity of the underlying data.

More than just data access, AlphaInterval is a powerful database system that streamlines complex workflows and enables strategic, data-driven decision-making.

Key Features of AlphaInterval

Row Colocation

AlphaInterval optimizes performance by storing reference intervals—such as prior quarter or prior year—within the same row, simplifying data processing. Each row contains absolute values, deltas, and percentage changes for easy analysis, eliminating the need for complex window queries.

Data Formats

With native support for data formats like Parquet, CSV, XML, and JSON, AlphaInterval integrates seamlessly into your existing workflows, minimizing the time and cost of integration.

Row-Level Aggregate Detail

AlphaInterval bridges row-based and document databases by storing aggregate series components—like cash to assets—within the same row. This approach preserves granular data for detailed analysis, while maintaining accessibility and performance.

Code Aggregating

Easily track evolving account codes across periods with AlphaInterval, ensuring sub-category details remain intact for a complete view of your financial datasets.

Dynamic Series

AlphaInterval offers an intuitive interface for managing regulatory changes, allowing users to define series breaks and automating the process for consistent, flexible data handling.

Cloud-Based

AlphaInterval is a fully cloud-based, non-downloadable software platform that's serverless and fully managed. We handle the infrastructure, so you can focus on building data products and extracting insights without worrying about maintenance or updates.

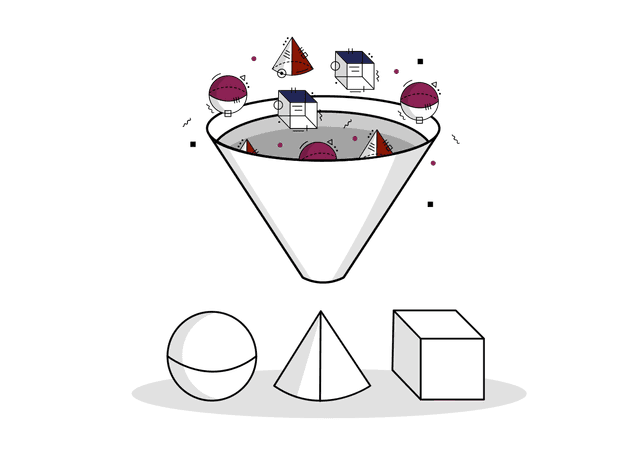

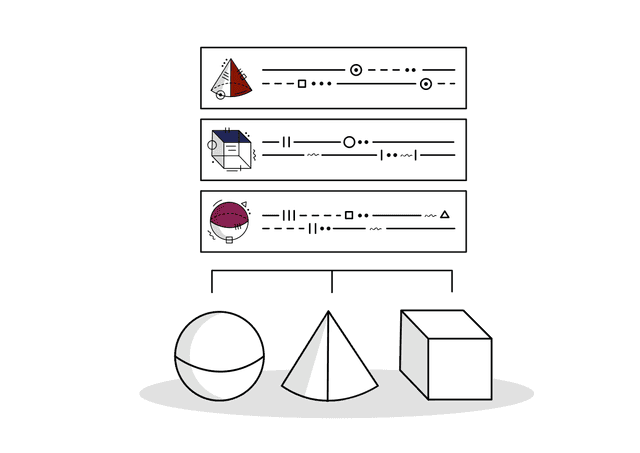

How AlphaInterval Aggregates Series Data for Financial and Economic Analysis

AlphaInterval allows users to aggregate and analyze time-series data with precision, handling regulatory changes while maintaining critical details, essential for financial institutions.

Source Data Management

Maintain the integrity of source financial data, ensuring all details remain intact, just like in traditional row-based RDBMS.

Summarize Data for Financial Insights

Aggregate financial series data while preserving row-level granularity, offering flexibility and precision across large datasets.

Aggregate with Flexibility

Combine row-based RDBMS benefits with document-like flexibility, making it easy to aggregate and query financial data while maintaining its structure.